What Happens When You Burn Money

What Happens When I Burn Money?

![]()

If you think you have the definitive answer, or my characterizations of the arguments aren't right, then please say.

Introduction

The deficits incurred in our attempts to tackle the economic consequences of the coronavirus pandemic are pushing theories about money to the forefront of public discussion once again. Economic crises always cause us to question money.

What is it? How is it created? How does it work? What should we do with it?

Sometimes we respond by reinventing money. Like we did in 1694 when the Bank of England was formed to make a loan to the king in return for a monopoly on the issuance of banknotes. Other times we reimagine money. David Graeber's seminal work Debt was written in response to the 2008 crisis and served to shift both the public and academic consensus on the nature of money.

A government's response to crises is predictable. Christine Desan lays it out with perfect understatement in Making Money (p.296):

"A government that urgently needs money… has two alternatives. It can tax or it can borrow. The alternatives might even overstate the options."

Borrowed money transforms crises into resolution but at a cost. The trauma is absorbed by the social body and sinks down to form a knot in our collective gut. The material discomfort associates itself to a thought that is itself already bound irrevocably to money. 'How will we pay for this?' we ask ourselves.

Money holds the pain of trauma. The social body ameliorates it not by discharging the debt itself but through distributing the pain in inverse proportion to each individual's share of the sovereign currency. The less you have, the more hurts.

I used to say that when I burned £20 economic theory predicted that I was giving it to everyone else. But increasingly people are questioning that claim. They say I'm simply gifting my £20 back to the Bank of England and there's no redistribution of the value represented by the note.

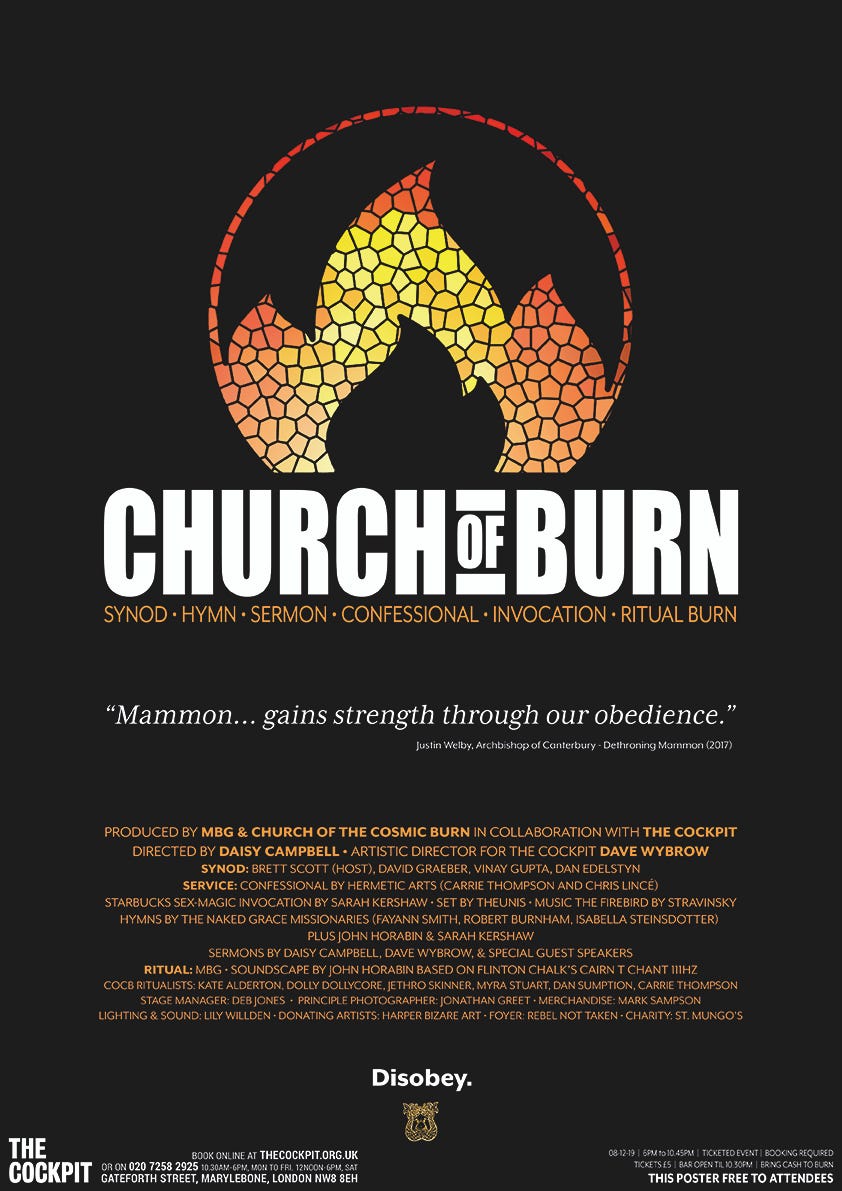

I don't necessarily have a firm intellectual commitment to any particular economic narrative. I remain to be convinced that any single map can precisely chart the territory of money. And in truth, when £20 is burned what happens to the piece of paper is less important to me than what happens to the person who burns it. But equally, as a High Priest of the Church of Burn I have a duty not to mislead people and I must reflect substantive claims about 'what happens when I burn money' in my conversations with would-be burners.

As happenstance would have it, when I started writing this essay Verso Books were promoting economist Grace Blakley's The Corona Crash — How the Pandemic Will Change Capitalism . As the title suggests, the book theorizes about the changes coronavirus might bring in its wake. Blakely believes it threatens to usher in a new era of monopoly capitalism and so makes her call for a radical response. To symbolise all this, Verso chose to use the image of a burning $100 bill.

Joachim Kalka says;

"…the tendering of a few coins over a shop-counter opens an abyss that reaches to the heart of the universe…"

If that's right, then surely something truly extraordinary happens when a banknote is burned?

I'd like you to tell me what you think happens; either in the comments, or in a separate response that I can link to.

I think burning a banknote challenges the detached and contradictory discourse that dominates our conception of money and instead instigates an intimate and playful conversation between an individual and their economic cosmology.

Burning money for the first time marks a material change in an individual's relation to it. Literally so. This is NOT insignificant.

A Word of Warning:

Although I hope this essay will appeal to everyone, I do go down some pretty deep rabbit holes. The central question of 'What Happens When I Burn Money? might be reasonably and meaningfully answered by a scenic journey through the act's symbolic or cultural significance. But this is not the path I've chosen. Instead, I've dug down into the theories that most immediately dominate our understanding of money, today. At times it can be an arduous journey that may test the will of even the most dedicated money nerd, let alone any companions who may be less enthusiastic about (or, perhaps unhealthily obsessed with) it's arcane details.

If you find yourself trudging wearily at any point, unable to see through the gloom of detail, please hold my hand tightly and remember these promises; (i) you are never too far away from illumination by the next stunning, never-before-seen, photograph from Church of Burn 2019 (all courtesy of Jonathan Greet), (ii) the essay's length (it's 20k words) is testimony not my verbosity but to the elucidatory power of its central question; and finally that (iii) there is a special reward for anyone who makes it all the way through — watch the video at the bottom to find out more (don't cheat, remember it's as much about the journey as the destination).

One Übermode of Thinking & Three Logics of Money Burning

There's no-one on Earth who's been in closer proximity to more people able to answer from their own direct experience 'What Happens When I Burn Money' than me. I hope that doesn't come across as bluster. It's just the statement of a pertinent fact. As a High Priest of the Church of Burn I am in a privileged position. I feel that what follows then, arises from this. I'm inside looking out. I'm attempting to understand what is common to, and what divides, the various attempts to explain, analyse and critique money burning as they are directed at me and those around me. My position then might be described as 'defensive'. And although I would reject a pejorative use of the word, I think it does have some merit because what I've tried to muster in this essay is a response that is precisely targeted at the threats as I see them. In my sights are those who seek to dominate the territory of money burning by dismissing, redefining, or in whatever way, contradicting my visceral experience of it.

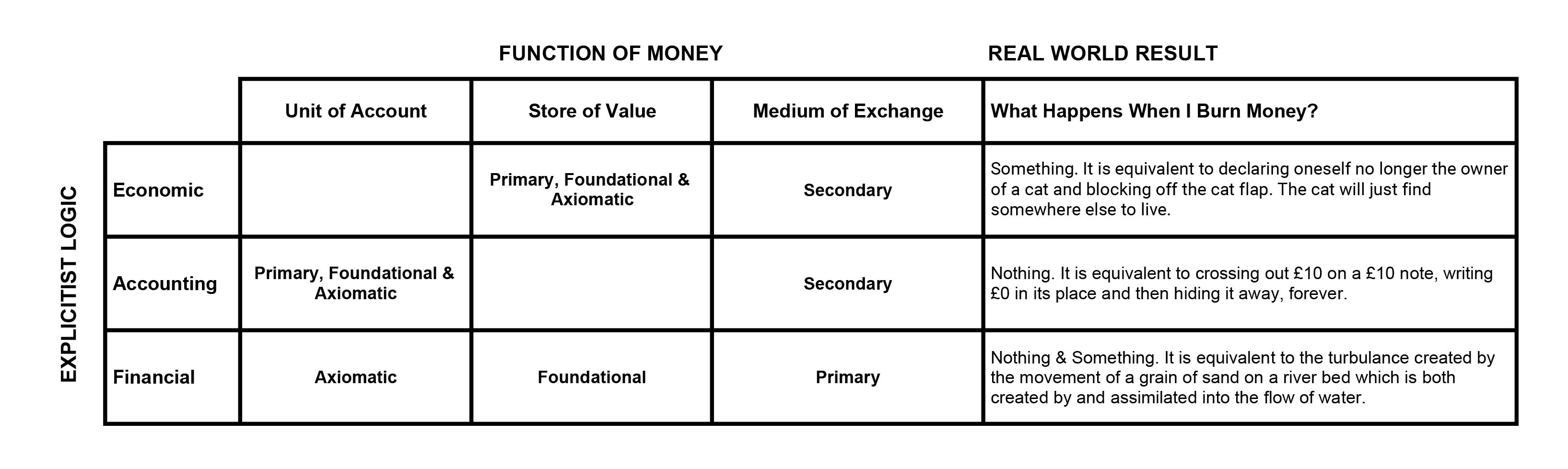

So, I'm proposing that a quality of Explicitism is common to the discourse currently dominating our understanding of the nature of money. The discourse itself can be divided into three abstract schools of thought (or, as I'll call them 'Logics') which I term Economic , Accounting and Financial — each has its own view about what happens when I burn money. I don't propose these schools in concrete terms — although I do believe between them they cover the dominant conceptions of money. I accept that in practice economic theories can take a Hybrid Form — they can draw from any or all of the three schools — although I will argue that doing so risks logical coherence. Furthermore, I maintain that the dominant mainstream discourse on money does not have a properly conceptualised or coherent theory of Waste .

Explicitism:

I propose that Explicitism describes all modes of thinking that share a desire to 'reveal what is hidden'. In practice Explicitism opposes the magical and mystical — that is, it opposes any mode of thinking (or being) whose unity is constituted by and dependent upon an 'unknowableness'. In its essence however, Expliciticism exists as 'exterior to' rather than 'in opposition of' the magical et al. For Explicitism , mysteries exist as 'unsolved puzzles' and as such they provide an end point for its general movement. Explicitisism stands in close relation to Scientific Naturalism, Materialism and Positivism, but I maintain it is possible for a person to disavow say, Materialism, yet also practice a mode of thinking that is essentially Explicitist .

[ I've discovered that Explicitism and Implicitisim are terms used within Aesthetics. I do not claim my use of Explicitism here, mirrors its use there. ]

The Economic Logic of Money Burning:

With a fixed amount of cash in circulation at any one moment, my burning of £20 causes an increase in the value of money. After I've burned there is less money chasing the same amount of goods and services. The purchasing power of the remaining money rises and this is reflected by a relative fall in the price of goods and services.The Accounting Logic of Money Burning:

When I burn £20 I am gifting the value of it to The Bank of England and, if they record my sacrifice, they can reduce their 'notes in circulation' liability by £20 thereby increasing their net worth by the same amount. In any event, the purchasing power of money in circulation is unchanged.The Financial Logic of Money Burning:

As you'll see later, I don't really have an easily relatable explanation about what money burning means from within the operative Logics of Banking, Finance and Payments. But I'm pretty sure that they don't think it's a good thing to do.

Hybrid Forms:

As I've indicated by my use of the term 'abstract' to describe the three Logics above, I do not mean to suggest that general theories about economic life fall in line neatly and exclusively with only one school of thought. Theories of economy tend to give money a Hybrid form. Monetarism for example is based on the 'Quantity Theory of Money' which sounds very much like it needs money to be a material thing, a store of value that can be stacked up and counted, and is subject to (as I've defined the term) an Economic Logic. But I don't think Monetarists would be happy with this, at all. They determine the 'Quantity Theory of Money' as an 'accounting identity'. Not concerned with the things themselves but rather with their 'flow'. They like to dematerialise money and talk about it being a ' medium' ; not only a 'medium of exchange', but also a 'medium of account' rather than the more common 'unit of account'. One leading monetarist voice has recently called for us to drop the idea that money functions as a store of value altogether. [ — I'll discuss the functions of money in detail later on. — ]

Waste:

At this early stage I want to note that the dominant mainstream discourse on money does not offer a properly conceptualised or coherent theory of 'waste'. It upsets, as Noam Yuran says drawing on a Veblenian approach to economy, 'any notion of utilitarian calculation'. Each of our three Logics (Economic, Accounting and Financial) regard waste as simply an undesirable outcome of their processes. They can only assimilate it by drawing it back into their respective logics and defining it within their own terms. Economics creates a commodity out of waste. Accounting creates a cost. And Financial Logic creates a sort of taboo. For all three, waste is opposed to productivity and efficiency and so it is a failure of process. And yet for human beings (at least for those able to resist the power of the three Logics to direct our every thought) our ability 'to waste' defines what is sublime to us — a day spent 'just doing nothing' can be the most precious of all. Examining money burning through the lens of these three Logics might then reveal as much about each of them, as it does about money burning.

[ — Chapter Five 'Waste' in Nigel Dodd's The Social Life of Money is an excellent entry point into, and summary of, the ideas and theories that circumambulate money and waste. — ]

[ — To be as clear as possible and at the risk of repeating myself: I am not suggesting with the above that Economists believe this about money, Accountants that, and Finance the other. I'm simply trying to distinguish what is essential to the different modes of critique I've experienced as a money burner. — ]

Some General Points about Money Burning

Before we begin to dig deep and consider how each of the Logics may answer the central question, it might be helpful if I lay out a few broader points relevant to all three. When talking to someone about money burning I always first try to explain it in terms of it being 'a form of ritual sacrifice'. A significant proportion of people instantly and instinctively understand and accept this. But many don't. Sometimes people appear as nonplussed by money burning. Such a reaction is curious and — I suspect — inexplicable in direct terms. In other words, detaching oneself from any notion that one might deliberately destroy one's own currency is really just a refusal to engage with its possibilities and meanings. Other times the mere contemplation of the act can provoke anger, moral outrage and derision. And this response is often directed toward me. What follows then are characterizations of the sorts of conversations I've had with people who've had this stronger emotional reaction.

1. Burning £20 is a waste of money. That £20 could have alleviated material suffering.

The Charity argument is reactionary and misconceived. At Church of Burn events, bar takings have always exceeded the amount burned in Ritual (in 2019 the sacrifice was £880) — and yet we have never once been criticized for the amount we spend on booze. We have however been heavily criticised (to the point of being threatened with disruption and protests) for burning money. Protagonists seem to feel there is a moral distinction to be made between spending money and destroying money. At one level this takes the form of a moral judgement about an individual and their choice to burn. But this is very shaky ground. The existence of Charities depends on ideas of economic sovereignty. Any moral opprobrium directed at a person should surely then apply to any form of non-essential or 'wasteful' spending? And then perhaps, it should be proportional to the absolute amount 'spent' rather than how it's wasted.

At another level a rationale operates. Simply put it is that the 'real value' (that the £20 represents) is irrevocably destroyed by burning money. And so our capacity — as a society — to alleviate material suffering through production has been diminished by burning a piece of paper. An example of this argument in action can be seen in this interview with Gay Byrne and Bill Drummond.

Arguments at both levels are inconsistent with the principles and economic theories underlying them. Their end point is inevitably an extreme form of asceticism.

Related to all this is a false assumption very often made by observers that I don't 'want' the money I burn. Unlike the Charity critique it is usually offered up as a light-hearted comment, rather than a moral condemnation. But even so it still reveals something profound. It has become so alien to the modern mind that one could desire something and yet choose to destroy it. Joke-making is the only way we can find to mitigate the contradictions and resolve the sense of awkwardness they provoke in us. And yet, simultaneously we have a profound knowledge of the sacred power of sacrifice and we instinctively understand that any sacrifice is not really a sacrifice unless something of value is given up.

2. My burning of £20 is so insignificant that it has no material effect and so it's not really worth thinking about.

Money burning must hurt the individual, a little. There is a sweet spot for the pain which for most people, on an average wage, is usually between £20 and £50. Ultimately though, the right amount to burn can only be known by an honest reflection on one's relation to money. In other words, what is burned must be significant to the individual in the moment of sacrifice.

In wider perspective of course, burning £20 to £50 is utterly insignificant; in the context of all sterling banknotes it is undeniably an infinitesimally small sum of money. But as well as pain, 'pointlessness' is crucial to the experience of sacrifice. If one believed that burning £20 would have measurable, material and direct economic consequences it would actually diminish the Ritual by turning it into another form of spending.

But equally, if burning £20 has no measurable material effect this begs a question; 'Is There a Critical Point? If so, Where Is It?' — in other words, if say £10 billion went up in smoke, would the effects be (a) my £20 burn magnified? or (b) or some completely different set of effects? These questions offer insights into the nature of money.

3. This is all academic — in the worst sense of the word — because burning money is just a really stupid thing to do.

There is a deep connection between money and thought. Not only in the sense that money sits in reflexive relation to the historical development of different modes of thinking — as Richard Seaford suggests for philosophy in Money and the Early Greek Mind, as Devin Singh suggests for theology in Divine Currency and Joel Kay suggests for science in Economy and Nature in C14th — but also in the sense that money and thought are intrinsically linked and remain formative of one another, today.

To dismiss the active negation of money or to be unwilling to consider the act's psychological, cultural, social and economic implications is to kowtow to an inconsistent and contradictory taboo. The negation of money in speech (saying for example; 'money isn't important to me' or 'I'm not in it for the money') is valorised to the extent that it can define an ideal of what is morally appropriate for a 'good' person.

But bizarrely, the actual negation of money — its wilful destruction by the act of burning currency — is seen by most (and I speak from personal experience) as heinous and immoral. In my view, the disavowal of this contradiction between speech and act — and a refusal to engage with moral and theoretical questions that arise from it — are symptomatic of a general failure to rise to the intellectual challenges that are presented by burning money.

[ — For a few related thoughts on this, please see my co-signed letter to the BoE in response to their Central Bank Digital Currency (CBDC) consultation. It makes the case that any CBDC should retain the capacity for destruction by its bearer. — ]

4. This is nonsense. No-one needs to burn their money to think about money.

The problem with this view is that it presupposes the value of intellectual knowledge over tacit knowledge and lived experience. Meaning comes from doing and value that exists in action that cannot be wholly captured in the data that action produces. I gave a talk at the Intersections of Finance and Society Conference in 2017 and I was asked by an academic 'What does it feel like to burn money?' It's an astute question because the feelings invoked are important. But there is only one wholly truthful answer — 'You have to do it, to find out'. Also, the experience of money burning is variable. It'll depend, in part, on how you conceive of what you are doing. And in turn the feeling you get, may then alter your conception of the act. What has been true for me, fairly consistently and profoundly so on some occasions, is that money burning is a moral action.

More on the Economic Logic of Money Burning

The above video from Marc Poitras makes the case in plain language: 'With one less dollar out there, all the other dollars are worth just a little bit more'.

A similar story is told by Steven Landsburg in his popular economics book The Armchair Economist .

Hollywood screenwriters and denizens of the college lecture circuit periodically rediscover the dramatic potential of a burning dollar bill. Typically the torching is accompanied by impassioned commentary — issuing from a sympathetic character on the movie screen or an aging cultural icon in the college gym — about how a dollar bill is nothing more than a piece of paper. You can't eat it, you can't drink it, and you can't make love to it. And the world is no worse off for its disappearance. Sophisticated audiences tend to be uncomfortable with this kind of reasoning; they sense that it is somehow dreadfully wrong but are unable to pinpoint the fatal flaw. In reality, it is their own discomfort that is gravely in error. The speaker is right. When you spend an evening burning money, the world as a whole remains just as wealthy as it ever was.

Let's think a little more deeply about what Poitras and Landsburg are saying; specifically about how the redistribution of value happens.

My friend Brett Scott from Altered States of Monetary Consciousness argues that burning a particular currency in cash, transfers — in the first instance — value to all the other holders of that particular currency in cash .

I'm not sure that the economic logic employed by Poitras and Landsburg suggests this. I think they imagine that when a particular currency, say $20, is burned the value is distributed across all units of that particular currency — whether they be in cash or bank balances (Poitras). And then any further adjustments that occur in other currencies — due to an increase in the value of the remaining dollars relative to goods and services — can happen through normal exchange mechanisms. Hence, Landsberg's claim that ' the world as a whole remains just as wealthy'.

Although no time scale is imagined within which the value from the burned note spreads around the world, a sequence of events does suggest itself. And I think that this is what Brett is tapping into. I have sympathy with his argument. It seems reasonable to suppose the thresholds between different forms of currency — say between cash and bank balances — mark a boundary that must be negotiated by the value emanating from the burned note. I'll come back to this idea of boundaries later when I talk about money and law in the section after next.

More on the Accounting Logic of Money Burning

This view sees my burning of £20 as a de facto internal adjustment to the balance sheet of the issuing central bank — in my case The Bank of England. This adjustment has no real effect on the value of money in circulation.

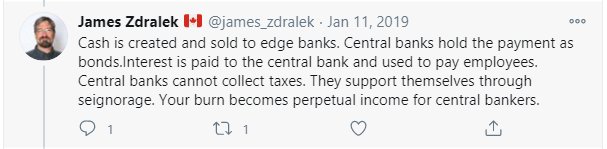

Here's a recent tweet thread from Wolfgang Theil rejecting the Economic Explanation:

Here is a tweet from James Zdralek making a similar point:

I should discuss the point that Wolfgang raises. Do the Bank of England know about the destruction of their notes?

Personally, I've only told them about one burn directly (see below). I got no response. But I also run a public 'Record of Burn' which details (as of 12 November 2020 ) the destruction of currency worth £2,684,999. The Record of Burn actually records all forms of currency destruction and, in some cases, provides evidential support of the destructive act.

According to Wolfgang, if a Central Bank decides to record my burning of £20 then there is a positive accounting consequence for them. Its liabilities are reduced and so its balance sheet becomes healthier. Conversely, if the Central Bank ignores my destruction of its currency, its balance sheet is unchanged. The debt remains on their books as a liability even though it has — in effect — been irrevocably forgiven.

However, for as long as they fail to record my act of debt forgiveness, EC56 496932 (£20) actually continues to provide an income for the Bank of England (details of how this magic trick is performed can be found on the BoE's website — see point 1). Hence, James Zdralek's claim that my 'burn becomes perpetual income for central bankers'.

More on the Financial Logic of Money Burning

As I've already stated and as I'll discuss again later on, I'm not convinced that the Financial Logic associated with the praxis of money is able to offer a coherent and consistent view on what it means to burn money. I suggest this is because they value pragmatism over rigor in their conception of money. This is understandable and appropriate. They need an idea of money that works 'in practice' and so their conception of it is malleable. It becomes a 'working fiction' that has an appearance of consistency but actually can be moulded to the narrative that's most efficacious to praxis, at any given moment.

Financial Logic is of course the most powerful of the three in terms of its practical ability to affect the constitution of social reality. They do have all the money, after all. Financial Logics subsume both the Economic view that money represents some claim on real resources and the Accounting view that money is really just a number, not a thing. They contain these multitudes by talking in terms of money being a 'generalized means of exchange' and such like. I'll talk more about that later on, too.

But for now, I want to just highlight one of the stories Financial Logic tells us. It's about money being at its heart a payments system that depends on agreements, regulations and laws.

I stress this story because it seems to me to offer most hope in terms of understanding what insight Financial Logics might offer in respect of what it means to burn money. But also it has to do with the notion of 'borders' that I mentioned in the Economic explanation and so it might help elucidate that idea, too.

Many — adherents of Modern Monetary Theory, most especially — believe that Law is constitutive of money. That is to say that the Law doesn't merely define how we deal with money but is profoundly implicated and present within the nature of money itself. I don't share this belief. I hold to the following:

…that the question of what can be treated as money under the law has: "nothing to do with a quite different problem; what is money in an abstract sense, what is its essence, its intrinsic attribute, its inherent quality?"

Essentially I believe that Law reacts to something we call money. The form money takes (that is, how it appears as currency) might be, and usually is, affected by Law. But for me Law is not money's essence.

I'm not a legal scholar and I know many adherents to Modern Monetary Theory have a deep understanding of Law as it relates to money. So I want to be as precise and upfront as I can here. The quote above comes from a key legal text on money;

Fredrich Mann's The Legal Aspects of Money (1992) as it appeared in Nigel Dodd's The Sociology of Money (1994) [ — p.28 in both books — ].

Mann's book was first published in 1938, is regularly updated and a new version (8th edition) comes out in July 2021. It costs £295 so it's not going to be an addition to my poor man's library of money books. However, I did manage to 'borrow' the seventh edition published in 2012 — the title has been changed reflecting Mann's death in 1991. The author is now Charles Proctor and the book is titled 'Mann on the Legal Aspects of Money'. Mann's 1938 musings on the relation of Law to the nature of money, that I've quoted above, do not appear in the seventh edition. Mann's humility, has been excised in 2012 for Procotor's more robust "The troublesome question, 'what is money?' has so frequently engaged the minds of economists that a lawyer might hesitate to join in the attempt to solve it. Yet the true answer must, if possible, be determined. For 'money answers everything'." (Section A 1.01)

But let's put myself, Fredrich Mann and Nigel Dodd aside for the moment and contemplate how it could be that money is fully a creature of Law.

First thing to ask yourself is do you consider the balance in your bank account to be money? The answer for most of us is 'yes'. It is these days the stuff we use most often to buy things, so it seems to work pretty well as money. But dig down into the rules by which International Banking operates [the Uniform Commercial Code] and you find that your bank balance isn't actually regarded as money at all. Only currency is money (effectively that's notes, coins, and central bank debt — which is what notes and coins represent). Your bank balance is a mere right to currency. At first sight this seems to negate the idea that money is a creature of law. However, as the legal scholar Joesph H Sommer explains, the distinction between the notes in your wallet and the balance in your bank prevents a very real problem; an infinite regress. If your bank balance — which is in fact your bank's liability — is money, then 'the monetary payment of a debt is satisfied by the monetary payment of a debt."

You can actually have a wonderful day out at the Bank of England experiencing this distinction between commercial bank money and cash (i.e £ banknotes) in real time, as I did in April 2016. I wanted to get some brand new notes to create a money collage. £230's worth to be precise. So I went to London to visit the Bank of England's public counter. As I walked in, I was stopped and asked about the purpose of my visit. I said I wanted to get £230 in cash. The security officer demanded that I show him the money I wished to exchange for the £230. I was a little confused. I said, 'Er, I was just gonna pay on my debit card.' He refused me entry to the public counter telling me that in order to get £230 from the Bank of England I must present £230 in cash . He told me there was a cashpoint just down the road at NatWest. So I went there, took out £230 (changed my claim on currency into actual currency), went back to the Bank of England and I was then allowed entry. I gave over my £230 at the public counter and was given £230 in exchange (in nice crisp brand new notes). [ I did a similar thing in 2017 but had a different and less reassuring experience. ]

To return to Sommer's point about infinite regress. He goes on to say:

"….infinite regress can be broken by what amounts to a leap of faith: an epistemological emphasis on the social construction of money. To phrase these words more succinctly, money is what payment systems do. The legitimacy of money, therefore, arises from our acceptance of the underlying payment system rules. These rules are nothing more than the homely law of bank liabilities and the law governing the transfer of these liabilities. As long as we collectively accept these rules, the infinite regress is not a real problem. If we do not collectively accept these rules, even currency is worthless."

Joseph H. Sommer Where is a Bank Account? (1998)

Sommer's rules can then, I suggest, be thought of as 'boundaries' between different forms of money (between banknotes and bank deposits). And moreover, the direct implication of Sommer's claim — 'If we do not collectively accept these rules, even currency is worthless' — is that the rules or boundaries, and our collective acceptance of them, are what gives value to money.

You can see a correspondence here with Brett's idea that there is a boundary between cash and bank balances and that a burned note transfers its value only to other holders of cash.

In physical form boundaries have an ancient relation to economy and not only in the obvious sense of sovereign territories. Statues of Hermes marked both the marketplace itself and its boundaries in ancient Greece. And today in our digital world, a failure to update boundaries in response to money's changing technologies — such as on which side of the banknote/bank-deposit fence a stablecoin sits — is seen as critical in allaying or mitigating financial and economic instability.

To finish then by returning to the question of what happens when I burn money according to Financial Logic. I must admit I'm still confused as to what the logic predicts. A banknote (currency proper) appears to be something that while it's treated as something special in the legal constitution of money, it actually isn't special at all. Burning one then appears to be an action which is both meaningful and not meaningful. It has real financial (accounting and economic) effects but simultaneously has no real effect at all. It merely destroys an imaginary boundary which in the course of our ordinary lives (i.e. outside of legal theories of money) none of us really care about. It's equivalent to me getting a UK atlas off my bookshelf and redrawing the borderline on a map of Wales to annex Bristol. My action is real, its effects are not.

A Discussion on the Functions of Money

We're already quite far down the rabbit hole. But we're going to go much, much deeper. I'd love it if you'll come with me, but if you need to dig upwards to get some air and then meet me again later on here is a sentence to explain where I'm going: I want to show how despite the fact that a functional approach to money underscores all dominant discourse it's not logically coherent to the practice of money and it causes harm to society.

I'm going to use the 'three functions of money' model in order to dig into the three explanations I've characterised above. Listed in no particular order, the three functions of money are; medium of exchange, store of value, and unit of account.

[ — I'm going to write the functions as inline code. — for the next couple of sections, anyway. I found that I was tending to put the functions in either italics or quotation marks or bold — it was all looking a bit messy. Writing them as inline code seems appropriate. It might annoy people. But I think it serves as a useful visual reminder, that if we do chose to describe money in terms of its functions, then the model we build upon them should be precise, consistent and logically coherent. I'll admit it's a bit of a provocation. — ]

I also need to define a few terms before I proceed:

(i) When I describe any particular function of money as primary I mean they're the most important. (Within a functionalist view) they most completely describe how money currently works and whatever we refer to as 'money' must have this function. ( Secondary means they're the second most important.)

(ii) When I describe any particular function of money as foundational I mean they're the initial historical condition of money. The foundational function is the historically necessary condition for the development of any subsequent function(s) of money.

(iii) When I describe any particular function of money as axiomatic I mean they're the initial logical premise for the idea of money. The axiomatic function precedes and lends coherence to the logic(s) of other function(s).

The idea proposed in the Accounting Explanation that The Bank of England generates an income from a burned £20 note seems counterintuitive and very confusing for your honest, hard-working money burner. It might be easier to think about, if we imagine burning money in the early 1700's.

If you've visited the Bank of England's museum you might've seen 'running cash notes' which promised 'a payee' and, most importantly, 'a bearer' a fixed sum upon presentation. They were basically a receipt for a deposit of gold or silver coin denominated in £'s (shillings and pence). But because they were payable to the bearer they could also function as a means of payment. If I'd deposited £10, and I then want to pay you £10, instead of going back to the Bank and withdrawing my coins, I could just give you my receipt for them instead. Financial instruments like these were the immediate precursors of modern banknotes, proper.

Now imagine that with my £10 'running bank note' tucked into my purse I decide to walk from the Bank of England southwards across Old London Bridge into the notorious Borough of Southwark. I drink excessively and then to impress my wealthy status upon my attractive and attentive companions, I burn the note. (Let's leave aside arguments here about whether such early instruments could be cancelled — if you deliberately destroy a £20 note today the Bank of England will not give another one to replace it). I now have coins deposited at the Bank against which there is a 'live' claim. The bank must honour it, so — to all intents and purposes — the coins in my account are lost to me. They are however still stored at the Bank who can (unlike me) use their value as a base against which to issue new loans. What the Bank has to do is to make sure that it has enough money (a sufficient fraction of reserves) to meet any claim as it is made.

Does this suggest, then, that EC56 496932 (£20) is the representation of a store of value? Like the 'running cash note', is my £20 a sort of receipt for a deposit? And if so, is there something 'real' and 'valuable' — an 'asset' — left behind when I burn the note? I mean, surely there must be something there, right? Because whatever it is, it generates an income.

However sophisticated one's understanding of central banking and the intricacies of the financial system, I think it's important not to dismiss these questions. Our lived experience of money is as a finite resource that directs our lives. A conception of money as a limited and material store of value is therefore in coherence with this.

The 'feeling' that money is a finite 'thing' also surrounds us in a temporal sense. From the past the materiality of gold haunts our understanding. And today bitcoin, which presents itself as the future of money, reifies the narrative that the primary and foundational function is as store of valueas Jon Matonis exemplifies in this tweet. Bitcoin's culture exemplifies a wider point about the store of value narrative too, in that it tends to cohere with a belief that property and property rights are fundamental to individual sovereignty. The very idea of 'property' relies on a conception that value can be external to the commons and collectively recognised as separated from the value held by others. The store of value function then is not simply an esoteric theory choice. It is deeply entwined and emergent with a broadly individualist*, 'freedom from', set of passionately held political commitments.

[ — *I'm not forgetting the commitment of Marxists to the commodity theory of money. But whereas the individualist view embraces and venerates money, the communitarian ideologies associated with Marxism tend to form in opposition to money (in its current form, anyway). — ]

The competing unit of account narrative is equally as entwined and emergent, but with a commitment that tends toward a belief that 'the individual is constituted by their community'. The politics that manifest from this are usually more 'progressive' and seek to re-frame 'equality' in terms of 'outcome', rather than 'opportunity'.

store of value and unit of account each make conflicting claims to be the primary and foundational function of money. And whereas as the former might best express what is most fundamental to our individual lived experience of money, it is the latter — unit of account function — which holds greater sway in academic discourse on money, today. Indeed, some individuals and institutions argue that the public must be 'educated out' of our mistaken view of money as — in itself — a fixed and finite resource. Their lesson plan is to explain that; (i) 'the state is not like a household' so high levels of 'public debt' don't automatically require policies of austerity; (ii) regarding money as astore of value has been reinforced by the false narrative of barter; and (iii) banks don't lend from savings but actually create money in the act of lending it.

I think it's often the case that the efforts of those who want to educate us about money fall on deaf ears. It's a difficult subject to make sexy. But I suspect this apparent disinterestedness actually arises as a way to mitigate or 'repress' the conflict between the 'feeling' of money's finiteness as it directs our material lives and the 'knowledge' that money is infinite, that it's really just a number. How the body-mind conflict is resolved at the level of the individual may depend less on the power and clarity of arguments and more on circumstance. When in pursuit of a fortune, or fighting to put food on the table, it may be more tempting to let the body dictate one's view of money. If we are of comfortable means and choose to direct our lives to other ends — say art, culture or wisdom — then repressing those bodily experiences from which we have successfully distanced ourselves, may be made much easier.

Geoffrey Ingham puts the case for mind — and for the unit of account— like this;

"The very idea of money, which is to say, of abstract accounting for value, is logically anterior and historically prior to market exchange."

Geoffrey Ingham The Nature of Money (2004) p.25

Ingham also argues that establishing aunit of account function requires 'an authority' — most often the State — and that what acts as money is established by 'collective intentionality'; i.e. the power of minds to be jointly directed at objects or values. Essentially, money is presented in this way as a 'public good'.

For my part, I tend to agree that if we do want to think about money in terms of its functions, then the unit of account is foundational , axiomatic (and probably primary , too). I don't agree that the unit of account requires 'an authority' nor do I agree with Ingham's specification that 'collective intentionality' establishes the money form. I'll tell you why at the end of this section. Before that I'll talk about the medium of exchange function and the problems the three Explicist Logics (of Economics, Accounting and Finance) experience in dealing with it. And I've also created a table to summarize what the Logics and the Functions say about what it means to burn money. Firstly though, I need to deal with the elephant in the room

The Elephant in the Room — What function do the functions serve?

Money is much, much more, than what it does. Many academics (Ingham included) recognise that an exclusively functional explanation of money is incomplete. I argue that reducing money to a set of functions misunderstands and misrepresents it and that such a reduction creates profound problems.

A functional description of the physical act of sex would be of limited value in defining the totality of the human sexual experience. Indeed, relying solely on such a definition would spell disaster for anyone navigating their life's intimate moments. Attributing a set of functions to money, which then serve to define its essence within all dominant theories of economy, creates a money object of perverse and brutal agency. This might be acceptable within the fantasy of a theoretical model, but it causes great harm when it's manifested into our social reality.

Nevertheless, this is where we are at. The President of the European Central Bank Christine Lagarde very recently (30th Nov 2020) wrote that central banks have a 'pivotal role in ensuring that money delivers on the three functions' — which she says are a 'means of exchange, a unit of account and a store of value'. Note the order in which she lists them. Legarde later confirms the medium of exchange as money's primary function when she says; " the value of money is based on citizens' trust in it being generally accepted for all forms of economic exchange " .

The narrative proposed by Financial Logic is that the primary function of money is as a medium of exchange. However, Finance does not regard the medium of exchange as money's foundational function. Legarde's says 'money first emerged… to overcome the limitations and inefficiencies of bartering.' Her story is one of evolution. Money has evolved from a store of value (foundational), into a unit of account(axiomatic), and then to its most perfect and complete form as medium of exchange (primary).

Legarde's history is of course disputed by many academics. As I said earlier, they refer to it as 'the myth of barter'. But Financial Logic demands pragmatism. And the authority and power of Financial Praxis ensures it's delivery. History is malleable and Financial History especially so. It is, as Amin Samman tells us in History in Financial Times, " something that must be imagined and produced ".

Some stories serve the present better than others. It can be helpful for bankers to recount a tale in which money is characterized as a thing — as some foundational and solid piece of matter acting as a store of value and then used as 'a means of exchange' — because in this way, banks are cast in the role of custodians rather than creators.

Before we examine Financial Logic's commitment to the medium of exchange as money's primary function and try to understand how or indeed if this would work coherently, let's first think about it from within the Logics of Economics and Accounting (as I've defined them).

The problem facing both Logics is that the medium of exchange function, whilst certainly allied with the other functions, must always remain subjugated; it can only ever be the junior partner in an alliance with either the store of value (for Economic Logic) or the unit of account (for Accounting Logic). For these Logics value must first be conceived of through measure, or experienced through ownership, before it can be exchanged.

To put that in terms of the axiomatic function of money; the

medium of exchangefunction could be (to use Ingham's phrase) logically anterior to one of the other two functions, but not logically anterior both . Only thestore of valueor theunit of accountfunction can be axiomatic (in the Logics of Economics and Accounting, respectively).To put that in terms of the foundational function of money; the problem for the

medium of exchangefunction is that we'd need either astore of valuelike a precious metal, or aunit of accountwidely agreed to be a measure of value, before we could put one of them to use as themedium of exchange. Either thestore of valueor theunit of accountfunction must always be foundational in any historical ordering of functions (determined by the Logics of Economics and Accounting, respectively).

So what magic does Financial Logic perform that allows it to install the medium of exchange at the heart of its conception of money? How can it cohere with the Economic and Accounting Logics other than through it's practical dominance of the domain of money?

To attempt to answer this question requires us to think about our experience of money. After all, Financial Logic is manifested in praxis so if we want to understand how ideas cohere with actions we need to match our inquiry into the idea of money with our experience of it.

A telling question to ask then might be: Is my experience of money fundamentally different to that of my ancestors? Given the technological advances in my own lifetime, given that the very first UK credit card was issued within my lifetime, you might even expect my day-to-day experience of money to be different to that of my parents, let alone my grandparents. And it's not. The most important effects of money — the way it structures our material lives and forms our social reality and disciplines us — have been unchanged for a very long time, maybe even forever.

Some essential aspect of money is shared between the exchange of silver for bread in the middle ages and my contactless payment in Aldi, today. And if that essential aspect was present in the mists of history, if the technology of money has grown around it, then surely that aspect — that 'function' as the three Logics would have it — must be the defining and essential experience of money.

Financial Logic's evolutionary story of money brushes this aside rather than explaining it away. Again, there is a present day pay-off to an envisioning of money's past as a Darwinian struggle of the functions and technologies of money. It not only justifies the existence of Financial praxis as a regulator and innovator but it also sets the conditions for faith in the future of money — the future becomes an extension of this evolutionary story of technology and function. This is evidenced by the weight of capital serving and sustaining Financial praxis itself and the volume of capital directed toward Fintech and all future-of-money projects.

If it is true — as Financial Logic has itself declared through its highest office — that the

medium of exchangefunction is not foundational:

And if it is true — as Economic and Accounting Logics insist — that themedium of exchangefunction cannot be axiomatic:

And if it is true — as our lived experience of money suggests — that its most essential aspect or primary function has been consistent (rather than evolved over time):

THEN Financial Logic's insistence on the primacy of themedium of exchangefunction is inconsistent.

Financial Logic presents a flawed conception of money but as we found out (not for the first time) in 2008, it cannot be allowed to fail. It will have coherence at any cost. Its failure is our failure. So it must perform yet more sleight-of-hand to persuade us of the primacy of the medium of exchange.

Before I examine this conjuration of coherence though, I want to state clearly that none of this implies the medium of exchange function is unimportant. I'll talk shortly about quite how very important I think it is. Obviously, what I'm arguing here is that whereas the Economic and Accounting logics are coherent in their ordering of functions, Financial Logic is not. Anyway, the trick that affords the appearance of primacy to the medium of exchange function within Financial Logic is as follows.

Each of the favoured functions of the Accounting and Economic Logics — although they remain somewhat opaque in themselves — point to a 'primitive notion'; to a store of value, or to a unit of account (i.e. number). Financial Logic points to a medium of exchange which by definition implies the interaction of separate entities. Exchange then, is not really a 'primitive notion' in the same sense that 'value' or 'number' are. Exchange (in Financial Logic, at least) can be defined in terms of simpler elements (we'll see later that the Simmel conceives of exchange in terms that might be construed as primitive). The sleight-of-hand Financial Logic performs, relies on the creation of a tautology which serves to persuade the innocent onlooker that the axiom does indeed have a primitive notion.

Money as a medium of exchange is presented as merely the short form version of the following; money is any object that is generally accepted as payment for goods and services . It serves to lend the appearance of rigor and consistency and provides the necessary launchpad for Financial Logic's Explicitist momentum.

So, in my view what sits at the heart of Financial Logic then is a tautology that has been transformed into a mantra-like utterance on the nature of money. Despite its conceptual failings Financial Logic nevertheless performs well as a working fiction about money. It gives the praxis of Finance the degree of flexibility and pragmatism it requires. It maintains the appearance of transparency despite its opaqueness. And if it comes under more intense scrutiny it can gain support by forming an alliance — a Hybrid — with Economic or Accounting Logics.

For example, a Financial-Economic Hybrid was recently employed allowing store of value and medium of exchange to both be the primary function of cryptocurrency . On 27th Nov 2020 the Guggenheim Funds Trust made a filing with the U.S. Securities and Exchange Commission announcing a potential $489 million investment in the Grayscale Bitcoin Trust — who invest solely and passively in Bitcoin. The filing determines that bitcoin is a digital asset but one that is " designed to act as a medium of exchange". Intentionality is thus inscribed in the very being of bitcoin — the medium of exchange function is inscribed into the store of value function. It reminds me of the 'intelligent design' argument put forward to assimilate evolutionary science into Christian Theology. Just as 'intelligent design' serves a Christian God making Him the nexus of value for all knowledge, a functional definition of money is made to serve the Financial Logic that dominates our material lives.

I do think it's possible (even desirable) to conceive of money as primarily a medium of exchange in a coherent way. But in order to do that we'd have to step outside the Accounting, Economic and Financial Logics. We'd have to reimagine our approach to money. I'll briefly explore some of the work on that shortly and offer my own thoughts.

But before I do, I thought it might be helpful to provide a summary of what three Logics suggest about what happens when I burn money. I've tried to provide a descriptive metaphor for the 'real world result'.

I think the Economic Explanation is the most easily comprehended result. Within its own logic and its conception of money — as outlined by Poitras and Landsburg earlier — it's coherent. Just to be completely clear, arguing that the explanation is coherent within its own terms is not the same as saying it's true.

The Accounting Explanation is a little trickier to get your head around. Within this view money is — as far as I can see — essentially reduced to 'points' awarded by 'an authority'. Wolfgang Theil illustrates this rather delightfully in his twitter thread (above) with a typo which substitutes 'points' for 'pounds'.

[ —Here and elsewhere I have argued that adopting a basic psychoanalytic framework would help us gain a better understanding of money. So, where Wolfgang sees a typo, I see a 'Freudian slip'. — ]

Money conceptualised (or at least analogised) as 'points awarded' is made explicit though, in this twitter thread by Stephanie Kelton. She imagines the Government as a 'scorekeeper' and US dollars as 'points' awarded in a baseball game. So how should I conceptualise 'burning points' within an Accounting Logic? Certainly there is the implication that burning money has no 'real' effect. My negation of awarded points doesn't change the score in the game. I guess it may change the way I play, though.

The Accounting Logic seems to suggest that what happens to me when I burn money is that I am putting myself under an unnecessary, self-imposed constraint while still competing in the economic game. Perhaps, rather than generously giving my burned £20 to everyone else as the Economic Logic suggests, I've actually diminished my personal productive capacity (and my ability to compete) and so my sacrifice has impacted negatively on the rest of society, as well as myself?

I'm least certain of all about what the Financial Logic suggests. Perhaps this is because burning money is so completely anathema to the praxis of finance that the action cannot be meaningfully assimilated into its logic? The reason d'etre of the Finance and Payments industries is the sustenance and growth of money. My action is therefore fundamentally incompatible with it. Of course — as I have argued above — I regard the Financial Logic as incoherent. It is no surprise that the 'result' I suggest in the table — of money burning being both nothing and something — is nonsensical.

However, in my explanatory metaphor I tried to give some linguistic expression to the tautology that masquerades as the logic's axiom i.e. that money is any object that is generally accepted as payment for goods and services. The metaphor seems to suggest that for Financial Logic, matter becomes part of a flow of something fundamentally non-material — desires, wishes, wants, needs etc — that are seeking satisfaction through a process of exchange. For me, this offers some insight. I'm not sure it's grounded enough for the pragmatists in Finance and Payments. But it does maybe point toward why, despite the incoherence of their logic (which I suspect many practitioners may be aware of), the praxis of finance circumambulates something which, however vaguely it is seen (or maybe because it is vaguely seen), is actually a truth about the nature of money.

[ — The provocation is over. I'm going to drop the inline code thing now! — ]

Money as a Medium of Exchange (Again)

Now I'm going to consider the medium of exchange function more deeply. I think it's important to do this in order to understand a different aspect of what happens when I burn money. The Economic and Accounting Logics point toward the effects of money burning that occur (or not) within their own areas. The problems I've outlined with Financial Logics prevent us from properly assessing what it means to burn money when its primary function is as a 'medium of exchange'. So if we could find a coherent way to conceptualise money as a medium of exchange primarily and/or axiomatically and/or foundationally , then this might help us work out what happened, say, when I burned EC56 496932 (£20).

So you might be relieved to hear that now we're going to move away from the Economic, Accounting and Financial Logics. I will maintain — for the moment — an Explicitist mode of thinking. I'll get into magical thinking later on.

Essentially, what we have to do in order to avoid the errors and fudges of Financial Logic is to emphasise medium over exchange. In other words, we must take seriously the ontology of media, itself. We have to think about what being a medium actually means. Scott Ferguson describes two contrasting views of media; the correlational approach where mediums are treated as "relatively neutral conduits that either succeed or fail to convey extant phenomena" and the constitutive approach which insists that any medium "actively shapes social reality, heterogeneously organizing and participating in worldly phenomena from within". He also goes on to say — and this is important because it prefigures the argument I'll make about magical thinking — on the constitutive view, media makes the world legible in ways that are always opaque and incomplete.

Ferguson bemoans the fact that while academics in the humanities and social sciences readily adopt a constitutive view of media in general, when it comes to money they seem stuck in a view that is correlational. In other words, they tend to see money as neutral, in much the same way that mainstream economics does.

Lana Swartz in her latest book New Money: How Payment Became Social Media thinks about money as a "communication medium dependent on particular technologies". In line with Ferguson's insistence on the constitutive view of money as media Swartz argues that "communication doesn't just document the world and share documentation of the world; it is [the] process through which the world is constructed."

So within both Ferguson and Swartz's view — and within the constitutive approach to media generally — burning money must have some meaning. It must impact on the creation of social reality, surely? This doesn't seem an outrageous claim for such a symbolically powerful act. I would guess that Ferguson views the negation of money as speaking directly to relations of credit and debt. Ferguson rejects the view that money is primarily a medium of exchange, claiming inline with his commitment to Modern Monetary Theory that it is a medium of credit and debt.

It's trickier to get a handle on what Swartz's view might be about the meaning of money burning. A substantive difference between her and Ferguson is that whereas for Swartz money is one of many media — as stated she tends to subsume money under a generalized notion of 'communication' — for Ferguson the medium of money is special; "money operates as a preeminent medium that mediates the myriad media that shape the world'" Ferguson's view is much more in line with my own. For me Swartz's view of money — whilst it opens a powerful perspective — can be subject to the same critique as was made of Viviana Zelizer's seminal work The Social Meaning of Money. Swartz and Zelizer seem to want to deny that there is something essential and ever-present across all forms of money. Zelizer argued that the idea of 'money in general' was invalid. This seems to imply that what happens when I burn money, will depend upon the meaning I attribute to it. I've already said that is very much the case. But it is not wholly so. Money is able to answer back with its own distinct and clear voice.

Whilst Zelizer's provocation served to broaden the academic appreciation of the cultures of money and the importance of behaviours like 'earmarking' — where money is differentiated by being given different meanings — it denied that there is any universal experience to money. Quite what it is that is common to 'money in general' may be tricky or even (as I think) impossible to unpick. But the 'feeling' that there is 'something' there — that there is some element of money that is the same today as it was to my parents and their parents as I claimed earlier — cannot be shaken off that easily. Ferguson's view of money as media, which draws on theological considerations of our relations with God, seems to point towards something more permanent and universal as being present within the money form. And despite not agreeing with his disavowal of exchange, I think his description of the medium of money is highly insightful.

Tony Lawson, a colleague of Geoffrey Ingham at Cambridge, has proposed a 'social positioning theory of money'. It is a theory that directly engages with the ontology of money. Lawson says that social positioning is "the process whereby, through general acceptance throughout a community, human individuals, things or other phenomena become incorporated as components of these emergent totalities." In this view money becomes a 'positioned' phenomena; the capacity of a disc of gold to act as money is 'harnessed' so it serves the needs of 'the overall embedding system'. Importantly, Lawson's view holds a presupposition that money does not reduce to 'what money does' — in other words, it cannot (as I argued earlier) be reduced to its functions. The functions required of money emanate from a 'position' that is determined by the community that brings it into being. While a money object may have certain capacities, its functions aren't inherent but rather are constituted by its occupation of the position of money.

Whilst Lawson's theory is not concerned specifically with money as media I do see correspondences between his insights into the ontology of money and Ferguson's into the ontology of media. Each provides a perspective on the relation between social reality and money. As stated, Ferguson is an adherent of Modern Monetary Theory. Lawson addresses MMT directly in his paper Money's relation to debt: some problems with MMT's Conception of Money. His critique engages with the view held by Ferguson that money is a medium of credit and debt. Lawson argues that credit and debt are two aspects of the same social relation. And this captures my confusion over Ferguson's claim. I'm not sure what it means to say that something is a medium of a particular and specified social relation. It seems too closed off. I'm unsure as to how money's universality (a quality which Ferguson seems happy with) could arise from this specified relation. Whereas the proposal that money is a medium of exchange offers something that is inherently more generalised and so offers a greater capacity for universality.

I'll come to Simmel shortly, but it's worth stating now that his notion of 'exchange' was not at all limited to 'economic' exchange. I posted In Defense of Simmel back in 2014 to try and make the point that Simmel's use of 'exchange' as fundamental to his understanding of money should not be understood as tacitly supporting free market neoliberalism. As Simmel himself says:

'The concept of exchange is often misconceived, as though it were a relationship existing outside the elements to which it refers. But it signifies only a condition or change within the related subjects, not something that exists between them in the sense in which an object might be spatially located between two other objects." (Philosophy of Money p.83)

So in this understanding of exchange, Ferguson's credit and debt relation becomes a description of particular changes 'within the related subjects'. As such credit and debt relations are one aspect of exchange relations. Simmel's definition of exchange points toward something much more universal. He says:

It should be recognized that most relationships between people can be interpreted as forms of exchange. Exchange is the purest and most developed kind of interaction, which shapes human life when it seeks to acquire substance and content.

Every interaction has to be regarded as an exchange: every conversation, every affection (even if it is rejected), every game, every glance at another person. (Philosophy of Money p.82)

However, while I think conceiving of money as a 'medium of (a broadly defined) exchange' is better way to think about money than as a 'medium of credit and debt' — not least as it allows for a deep connection between money and sex (I'll come back to that at the end of the essay) — I do prefer Ferguson's conception of money as a 'meta-medium, wherein many additional media become nested'. In Lawson's conception, money is just not that special. It is merely a particular instance of social positioning. Important of course, but unique only in so far as that, by their nature, every 'position' constituted within social reality is also unique. This troubles me.

There are many diverse aspects to my social reality. But every aspect seems in some way related to either sex or money or both of them. In terms of that which directs my material life, money and sex seem to occupy uniquely powerful positions. I'm suspicious of any theory of money (or sex for that matter) which disavows its uniqueness as a phenomena or underplays its constitutive role in my lived experience. I have a little history with Lawson and his underplaying of money.

Twenty years ago, I ventured outside my normally strict focus on money itself to read his then recently published Economics and Reality (1997). It superbly deconstructs and critiques the Hayekian influenced economics which were so dominant at the time and introduced me to the work of Roy Bhaskar. There is much to admire and be thankful for. However, there is not one mention of money in the entire 364 pages of Economics and Reality. For me the omission was indefensible. I did buy Lawson's Reorienting Economics (2003) but haven't been able to get over my objection. I checked the index, saw that 'money' wasn't listed and it's just stayed on my bookshelf unread ever since. So then finding out that in recent years Lawson had begun to address the absence of money in his work was great news. Social Positioning seemed to hold real promise as a way to break out of the impasse in the arguments about this or that function of money being primary, axiomatic or foundational. But then he has to go and say this:

"Many observers, of course, interpret the noted markers or tokens of money as money itself. However, cash and electronic entries are not money, at least as I am using the term, and nor is (any form of) bank debt per se. Rather money, currently, is any appropriately positioned form of bank debt that the cash and electronic entries serve to mark." (link)

Ignoring the complexities of what precisely is and is not money according to Lawson's theory, the takeaway point for me is that when I burn £20 (Lawson says) I'm not even burning money at all. And to me this is truly absurd.

If we have reached the point in our current attempts to explicate the nature of money, where the theories of the brightest and best of our scholars conclude, that what appears to every individual as our most money-like object is, in fact, not money at all, then we may have hit the limit of possibilities for these modes of Explicitist thinking.

One thing that immediately endeared me to Georges Bataille's The Accursed Share was when he said in the preface 'he would not have written [The Accursed Share] if he'd followed its lessons to the letter'. He says his 'research aimed at the acquisition of a knowledge; it demanded a coldness and calculation, but the knowledge acquired was that of an error, an error implied in the coldness that is inherent in all calculation.' (p.11) I argue that here he is recognising and (paradoxically) revealing something of the 'general movement' (a term which I have stolen from Bataille) that I have tried to capture in this term 'Explicitism'.

And like Bataille, if I adhere to my recognition, that failure to meaningfully understand the nature of money is inherent to the Explicitist mode of thinking, then I should end this essay now. I should perhaps simply reiterate that 'meaning comes from doing' and abandon Eplicitism in favour of Mysticism and/or (my preferred) Magical Thinking. But I can't let go quite that easily. I need to finish things off, return to those disagreements with Ingham about the unit of account function of money and explain why, despite agreeing with the view of my progressive (& MMT) friends about the primary function of money, I don't think it needs 'an authority' (as Ingham suggests) nor is any explanation of money's nature (that proceeds along the lines of Searle's 'collective intentionality') sufficient, without reference to and the inclusion of the unconscious.

For Ingham, who draws on Richard Searle, collective intentionality might be seen as something of a misnomer (most especially if one associates the term with something like Jung's collective unconscious). Searle's definition of 'collective' doesn't suppose any magical blending of consciousness or social substrata of intuition but instead insists that 'collective' intentionality has to exist inside individuals' heads. There, it takes the form of 'we' statements. So by imagining ' we think Gold is money', Gold becomes money. The ' we ' element (as it exists in individual minds) is therefore what constitutes a joint action and is the core characteristic of cooperation.

By adopting Searle's idea, Ingham can safely keep money in a box, locked in not just by a rigorous Explicitism, but also by a reductionist, materialistic, atomistic Logic. There is no need for magic, at all. Or an unconscious. This is a problem. A totalising theory of the nature of money must contain the possibility of alterity. Ingham sees puzzles where there are mysteries.

Let's briefly explore this in relation to gold and silver. Between 1999 and 2002 the UK Treasury sold over half its stock of Gold. The value of Gold had been rationalised away. The belief that a shiny yellow metal could act as a store of value had been exposed as primitive and irrational. Gold was history and its sale signalled faith in the rule of reason and modernity's understanding of money and economy. The sale netted around £3.5 billion. Today you'd get around £12 billion. The incoherence of Financial Logic and the pragmatism that it afforded the Bank of England lent them an almost divinatory power. They weren't keen on the sale and counselled the Treasury against it. But different logics ruled in Westminster and the sale was pushed through, anyway.

Even though the Treasury's logic may have been correct and coherent within its own terms, it was wrong when applied rigorously to the praxis of finance. What it failed to factor in — what got written out in their rigor — is that Gold is of the Sun and Silver is of the Moon. Whether this is literally, materially or logically true is beside the point. It has been the story for every human being across time. It is an ancient truth, nested in our unconscious. Keynes told us that Gold was originally stationed in heaven with his consort silver, as Sun and Moon. Failure to take the unconscious seriously causes grave and costly errors — £8.5 billion's worth to be precise.

I disagree with Ingham's proposal that the unit of account function requires 'an authority' to establish it. I don't deny that 'an authority' would help. However, I agree with Simmel's view that the unit of account function actually arises from an unconscious equivalence of absolutes. Note here that Simmel's view roots money in the unconscious — a space that is by its definition not directly accessible to the conscious mind — and by doing so presupposes and manifests an alterity at the heart of money.

Simmel's idea is pretty weird to be fair. The headline version of it is that the unit of account function arises from an unconscious equivalence between the total amount of money and the total amount of goods. In my Barefoot in Bollingen piece I explain that it took me many years to assimilate this. It's like one of those uncomfortable 'truths' Freud told us about 120 years ago. Rejection is part of the process of acceptance. And like Freud's ideas, Simmel's notion of how the unit of account function is established is more palatable if you think about it abstractly. There is no 'equivalence' between God and the Universe. God is all things and all things are within God. Likewise, the Universe is all things and all things are within the Universe. Both are conceptions of the absolute. And, in this sense of them both being absolutes therefore, they cannot exist simultaneously and so there can be no equivalence between them. And yet there is. In the act of perceiving both we create the equivalence between them. We do so not in the rational mind (which denies that any such equivalence can exist) but rather at an irrational and unconscious level.

[ — It seems obvious but also worth noting, that our two most significant celestial bodies who we would have worshipped as a God and Goddess for the majority of humankind's existence are Father and Mother to Gold and Silver, respectively. The idea then, that the unit of account function of money stemmed in the first instance from this relation, parsed through to our relative valuation of gold to silver, would seem to me a reasonable explanatory proposition for how money as currency secured and expanded its role in social reality. — ]

So then, when I burn money in Ritual I believe that I'm talking to the irrational and unconscious part of our psyches that has a capacity to manifest the fundamental equivalence that underpins money and our financial lives. I'm not 100% sure what I'm saying to it, nor what its response is. But I suspect — and hope — that some form of 'resetting' or 'realignment' takes place so that the measure of money — and the logics that arise from it — might no longer subjugate themselves so wholeheartedly to the accumulation of wealth and power. And that maybe our behaviour around and relationship with money might flourish to open up possibilities for new ways of being.

Magic and the Legacy of Money

I'd been trying to persuade David Graeber to come along to Church of Burn for several years. When making plans for our December 2019 event I asked again. He said he would if he was around. But then things went a bit quiet. Cut to a few weeks before the date and David published a review of Robert Skidelsky's Money and Government: The Past and Future of Economics.

David writes:

"What [the book] reveals is an endless war between two broad theoretical perspectives in which the same side always seems to win — for reasons that rarely have anything to do with either theoretical sophistication or greater predictive power. The crux of the argument always seems to turn on the nature of money. Is money best conceived of as a physical commodity, a precious substance used to facilitate exchange, or is it better to see money primarily as a credit, a bookkeeping method or circulating IOU — in any case, a social arrangement? This is an argument that has been going on in some form for thousands of years. What we call "money" is always a mixture of both, and, as I myself noted in Debt (2011), the center of gravity between the two tends to shift back and forth over time." [ — my emphasis — ]

As soon as I'd read the review I sent a short email to David. I just quoted the words "The crux of the argument always seems to turn on the nature of money" and wrote that there was no way he could make this statement and not then come to Church of Burn. He replied straight away with a simple 'Ok'.

The opposition between money as a physical commodity and money as a social arrangement, can be mapped fairly directly and respectively onto Economic Logic and its conception of money as a store of value and Accounting Logic and its conception of money as a unit of account. I've argued that this fundamental ambivalence is resolved — or more precisely, given the 'appearance of resolution' — in Financial Logic.

Lifting our gaze from money itself we see the same oppositional dynamics (and their resolution in praxis) operate at the macro level as economic theories vie for adoption as political policy. Disputes between economic theory attain the temporary appearance of resolution via their implementation. As David says, it's not 'theoretical sophistication or greater predictive power' that determines theory choice. It's politics that picks the winner. Ultimately, whether presented as 'nourishment for growth' or 'cure for malady', the economic policies presented must at some level appear — just like Financial Logic — to resolve the question of whether money is finite (a commodity) or infinite (a social arrangement). Inevitably and tellingly, in public discourse all this is reduced to the question of whether or not there is 'a magic money tree'.

So why is it that, as David says, the same side always seems to win? Why does the magic money tree disappear like the Cheshire Cat? Why is our belief that saving money will save the world so unshakeable. Why do we hold to this faith even when we know that money is the oxygen on which the fire of global warming burns. Why do we seem more comfortable contemplating climate catastrophe than we do questioning the nature of money? Why ultimately, is austerity always the answer? Why must indulgence be subjugated to asceticism in the moral order of economy?

The case I've made in this essay is that the answers to those questions lie in the fact that money as store of value and money as a thing cohere with our lived experience of it. In our day-to-day lives we experience money as finite. The ability of democratically elected politicians to fund, effect and instigate change is necessarily limited by the beliefs and prejudices of its citizens because it is those beliefs and prejudices to which the politicians must appeal in order to gain power.

In a vulgar sense then, the project of money burning — and Church of Burn — might be regarded as a means by which misbeliefs and prejudices about money can be challenged. If it's true that 'the same side always wins' because people are unable to distinguish between their own finite, individual experience of money and a social order in which money circulating as an extension of sovereign power can be created at will, then money burning might be regarded as an educational project *. But this 'educative' view lacks beauty. Its truth is diminished by its adherence to Explicitism. Any answer to 'What happens when I burn money?' which claims it creates the possibility for 're-education' would be profoundly incomplete and incongruent to the experience of Ritual Sacrifice.

[ — Please note the caveat "If it's true that"; I am not saying that I believe money is 'an extension of sovereign power that can be created at will'. All I'll commit to is that money is fundamentally ambivalent and that until now, for the most part, only one side of that ambivalence has been expressed. — ]